Many specialists believe that, as a result of anti-Russian sanctions and US pressure on business, and particularly on the Turkish financial system, starting from January this year Turkish banks have had to stop or freeze bank payments to Russian partners and refuse to service transactions involving Russian legal entities. If this situation persists it will naturally have a negative impact on the overall trade balance between the two countries. But there is always a solution – it is just a matter of price.

The development of trade and economic relations between Russia and Turkey is closely dependent on the availability of financial support for exports and imports. In other words, finance and banks function as the arteries of economic communications, and their disruption leads to undesirable consequences for the parties to transactions.

According to the Russian Consul General in Istanbul, Andrei Buravov, in 2023 trade turnover between the two countries was $48.5 billion, $11 billion lower than in 2022. The main reason for this decline was the deterrent effect of Western sanctions against Russia, and the threat of secondary sanctions against violators of the sanctions regime.

In reality, Russian businesses began to experience payment restrictions in Turkey shortly after the beginning of Russia’s special military operation in Ukraine in 2022. But the problem has become more widespread since January 2024. Arsen Ayupov, President of the Russian-Turkish Dialog Association commented on this issue in an interview with the Russian business media outlet RBC: “Accounts of Russian companies in Turkey began to be closed as early as 2022. At that time these were specific incidents involving individuals and companies that were subjected to sanctions. Today, the situation has become more extensive, but I would not describe it as a general policy, covering the whole range of Russian businesses.”

Most of all, it is payments from Russia that are being blocked. As a rule, Turkey gives the Russian businesses sufficient time to withdraw their funds from Turkish banks so that the company does not suffer financially or suffer any risks to its business. The situation changed dramatically in December 2023, when President Joe Biden signed an executive order imposing additional measures on foreign banks and other financial institutions involved in transactions related to the supply of dual-use goods for the Russian defense industry. This new order includes prohibitions and restrictions on opening or using correspondent accounts, and enables the blocking of property held in the United States.

And here, as many Russian experts sympathetic to Turkey have pointed out, the Turks, being pragmatic people, began to weigh their risks and benefits. And if the risks even slightly outweigh the potential benefit, they will not want to get involved. These experts are either seeking to excuse the actions of their Turkish partners in the banking sector, or they do not know what kind of payment to expect in return for their services, or they are lacking in objectivity.

In reality, irrespective of their nationality, people engaged in business (including the banking sector) will always focus on pragmatic considerations, and calculate the benefit and profit to be gained from transactions. Certain experts would have us believe that the Turks are more pragmatic and rational than Russians (Turks, apparently, are focused on the benefit, while Russians are generous and altruistic). This, of course, is a laughable idea and is completely untrue. In business national psychology plays no role at all, or at least it is always trumped by financial factors.

Alexey Egarmin, General Director of the Russian-Turkish Business Council, rightly points out that Turkish banks are under serious pressure from US and European regulators. The fact is that many shareholders of Turkish banks are from countries on Russia’s list of “unfriendly” states, and in combination with external regulators they have presented Turkish banks with a choice – either to stop working with Russian companies or to see their correspondent banking relations with Europe and the US terminated. In the end, the Turks chose not to side with Russia.

The difficulties in making payments from Russia to Turkish banks are also causing problems for Turkish suppliers, because payments for Turkish goods already delivered to Russia are not being accepted. Any discussion of “endless Turkish pragmatism” clearly ignores the fact that the disruption of bank payments made by Russian companies is also having a negative impact on the Turkish economy, which has lost billions of dollars as a result. Last year, the trade turnover between the two countries decreased by almost 20%. According to Tatiana Kulyabina, CEO of Holding Finance Broker, the refusal of Turkish banks to process payments from Russia could result in great losses for the Turkish economy.

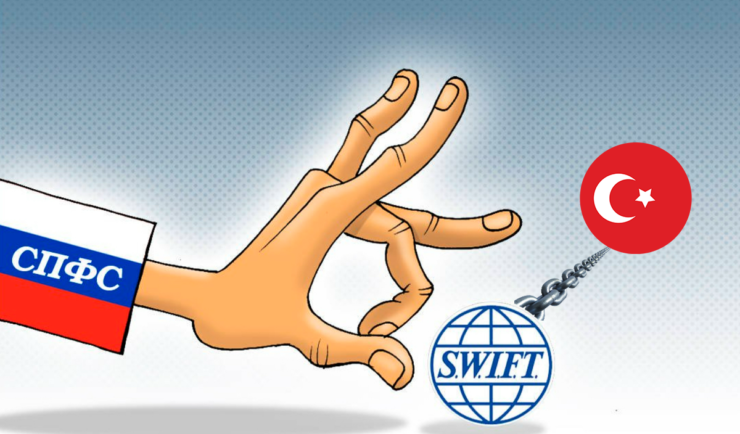

The whole problem comes down to the question of the international financial payment systems used by banks. Turkey is dependent on America’s SWIFT system. Meanwhile, due to political factors and the threat of Western sanctions, other countries have developed alternatives to the SWIFT system. For example, China has established the Cross-border Interbank Payment System (CIPS), India has developed its Unified Payments Interface (UPI), and Russia developed its own System for the Transfer of Financial Messages (SPFS) after 2014, following the first Western threats to disconnect it from SWIFT due to its annexation of Crimea. Iran is also, as a result of the sanctions imposed on it, is independent of the SWIFT system, is developing its own independent system of bank payments, and is integrating quite well into the Russian SPFS. In principle, Turkey is also in a position to develop its own payments system, but this requires experts in the field, and a lot of money and time.

According to the head of the Central Bank of the Russian Federation Elvira Nabiulina, 159 foreign companies from 20 countries have already joined the Russian SPFS system. In other words, the SPFS is already being used to support Russia’s financial transactions with foreign countries, and Turkey could take advantage of this opportunity.

That is why Russia is proposing to its partners that they start using their own national currencies in foreign trade transactions, which implies an increase in deposits in those national currencies. It is no coincidence that the new head of the Central Bank of Turkey, Fatih Karahan, recently urged bank managers to increase the volume of deposits in lira (although given inflation of 65% and the devaluation of the lira such a task is difficult to accomplish).

According to media reports, Moscow and Ankara have entered into talks on the use of the Russian SPFS system in financial transactions between the two countries. Experts are currently looking into this option in order to avoid undesirable situations in the future.

In short, it is clear that the Turkish banking system is dependent on the American SWIFT system and is subject to fluctuations caused by geopolitical processes. Turkey likes to position itself as an independent geopolitical player. However, the situation in relation to bank payments shows that Ankara’s interests in the banking sector vary depending on both internal and external circumstances. Accordingly, Ankara’s banking policy may change in response to developments in Turkish-American relations.

Denis Astafiev, head of the investment company SharesPro comments: “Payments between Russia and Turkey have partially recovered. However, the issue is still unclear, and is not as simple as it seems. As far as relations with Russia are concerned, they may improve, with an easing of restrictions and an expansion of the white list, and they may get more strained, with restrictions on the flow of goods and on transactions. Turkey likes to bargain in order to maximize its profits, and so if a particular solution is favorable to it at any given moment then the provision of services and supply of goods will go ahead and payments will be made.”

Russia remains a major market for Turkish goods. The agricultural sector, light industry, especially textiles, and the construction sector account for the majority of Turkey’s exports to the Russian market. Taking into account the withdrawal of most Western companies from the Russian market, Turkish companies are enjoying very favorable conditions for the development of their own businesses in Russia. That is why Turkish banks, as Alexey Egarmin notes, have once more started accepting payments from Russia – but only for white-listed products. In other words, the Turks have allowed Russia to pay for their products.

However, Turkey hopes for an increase in the number of Russian tourists visiting the country, and increased supplies of Russian oil and gas, not to mention Russian fuel for nuclear power plants, and these could be suspended if Russian companies lose access to supplies of, for example, equipment for the machine-building and automotive industries. If that were to happen, Russian companies would simply have to look for other suppliers (for example from Iran or the Arab states, rather than from Turkey).

So far, Russia has preferred not to show any particular discontent with actions taken by Turkey that conflict with Russian interests. These include its recognition of the territorial integrity of Ukraine within its 1991 borders, its opposition to the reunification of Crimea with the Russian Federation and the current situation, its provision of military assistance to the Ukrainian Armed Forces (supplies of drones, mortars, armored vehicles, and also fighters from the SADAT Private Military Company), its transfer of captured fighters and commanders from the Ukrainian nationalist Azov Battalion (an organization banned in Russia) to the Kiev regime contrary to the earlier agreements between Moscow, Ankara and Kiev, its construction of the Bayraktar UAV factory near Kiev, its military operations in northern Syria and occupation of a 30-kilometer zone and its arbitrary military and political intervention in Transcaucasia, an area where Russia traditionally has interests, and its price speculations in the “gas hub” project.

However, Russia’s restrained stance has been in many cases a reflection of Turkey’s strategic importance in terms of trade and economic relations, given the sanctions against Russia. If, whether under pressure from Washington or for its own opportunistic reasons, Ankara starts to obstruct balanced relations with Moscow, Russia will have no reason to look the other way the next time Turkey starts being difficult. After all, if Ankara blocks supplies to Russia, why should Russia open up the Zangezur corridor – part of the North-South cross-border transportation route linking Turkey with Central Asia? This unwelcome development would lead to serious changes in the partnership between the two countries.

Thus, Turkey’s keeping on with its policy of having “white” and “gray” lists for bank payments with Russian companies and still remaining in Moscow’s good books cannot continue forever, because:

firstly, this policy is inconsistent with the interests and spirit of strategic partnership, as universally understood;

secondly, there are alternatives bank payment systems, and Turkish companies can use the Russian SPFS system instead of the American SWIFT;

thirdly, Turkish pragmatism in financial transactions and business in general cannot be allowed to trump Russian interests and pragmatism;

fourthly, Turkey is not Russia’s only potential partner, and may find itself replaced with a different country, for example, the UAE or Egypt;

fifthly, the geopolitical loyalty of the banking sector in Ankara finds itself in conflict with Moscow’s own changing geopolitical needs in relation to issues of great importance and sensitivity to Turkey.

Everything has a limit, price and time, and the ball is now in Turkey’s court.

Alexander SVARANTS – Doctor of Political Sciences, Professor, exclusively for the online magazine “New Eastern Outlook”