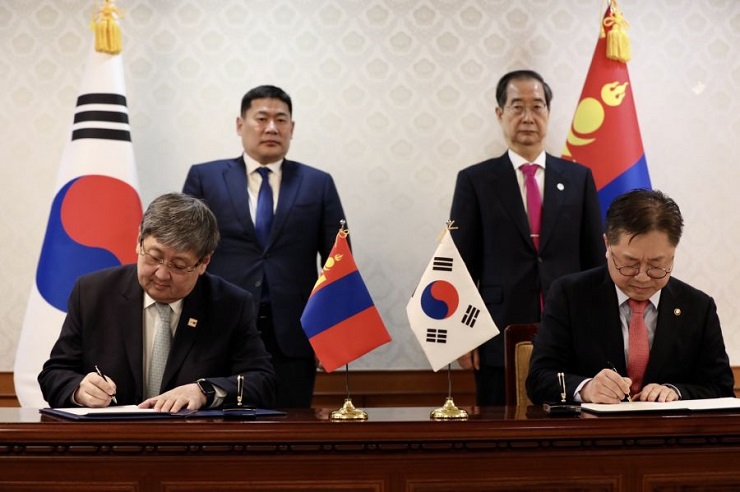

Mongolian Prime Minister Luvsannamsrain Oyun- Erdene’s visit to South Korea was marked by a number of important bilateral meetings and agreements. Especially notable among them is the memorandum of understanding signed on February 15, 2023, on the establishment of a network for supply of rare earth metals from Mongolia to Korea. The agreement calls for South Korea to actively participate in training, exploration, and infrastructure development for the further extraction of rare earth metals in Mongolia and their export to the Republic of Korea (ROK).

For an objective understanding of the prospects of cooperation between the two countries in this industry, as well as its possible macro political implications, it is necessary to recall that the rare-earth metals include 17 chemical elements from the Mendeleev Table – scandium, yttrium and 15 so-called lanthanoides. Their extraction and transportation have the following advantages:

-A large proportion of the elements are generally found together in a single deposit.

-Their insignificant extraction in comparison with other minerals simplifies the task of their transportation.

-The need for rare earth metals in the world economy is growing rapidly.

The possibility of organizing their extraction by a relatively cheap open-pit method.

Projecting these advantages on the Mongolian situation, we can talk about the demand for this resource for Mongolia’s trading partners, the rapid payback of its development, as well as the possibility of its export bypassing the territory of China. An important advantage is the ability of Mongolian rare-earth exports to provide raw materials for a wide range of industrial sectors of the potential importing country.

Currently, the following deposits of rare earth metals in Mongolia are known to be suitable for industrial development: Khalzan Buregtei (Khovd aimak), and Shar Tolgoi (Ubsunur aimak). The peculiarity of these deposits is their remoteness from transport routes – they are both located in the least developed western regions of Mongolia. According to geological expertise, the extraction of rare-earth metals can provide the largest increase in GRP of these areas of the country (growth up to 67%). Consequently, the task of economic development of the western regions of Mongolia will largely lie in the development of deposits of this resource. However, most of the country remains unexplored for deposits of these elements. In particular, there has been little exploration in the Mongolian Gobi, which some experts believe could prove to be the most significant storehouse of the valuable resource.

Supplies of rare earth metals from Mongolia could be the key to diversifying Mongolia’s mining exports: it is currently entirely dominated by coal from the Tavan Tolgoi deposit, the vast majority of which is shipped to China. The advantageous ratio of the value of rare earth powders to their mass opens up broad prospects for their export to other countries. And the first country that was interested in such an opportunity at the state level was the Republic of Korea.

The Mongolian side expressed its interest in the participation of South Korea in the development of deposits of rare earth metals in August 2022 during a meeting of foreign ministers of the two countries in Ulaanbaatar. In January 2023, Korea Telecom expressed its desire to cooperate with the Mongolian government on their exports. And now, a month later, namely on February 15, 2023, it became known about the signing of a memorandum of understanding to explore imports of rare earth metals. Another agreement is likely to see the light of day in the coming months: Oyun-Erdene gave South Korean President Yoon Suk-yeol an invitation from the Mongolian president to an official meeting in Ulaanbaatar, which was received with great approval.

South Korea also has an interest in developing this area of cooperation. Moreover, it is not limited to the economic dimension alone. It is well known that China accounts for more than 90% of the world’s production of rare earth metals. The Chinese authorities have repeatedly taken advantage of this position in the world market: for example, China imposed restrictions on exports of rare earth metals to the US in 2019. The problematic “issues” in its relations with South Korea are growing: therefore, reducing dependence on Chinese supplies of rare earth metals is among the industry priorities of the Koreans. Moreover, China has already imposed economic sanctions against South Korea in 2016 in response to the placement of US missile defense elements on its territory. Consequently, investing in the mining of rare earth metals in Mongolia is a good and fairly cheap opportunity to reduce dependence on Chinese supplies.

Nevertheless, bilateral cooperation between Mongolia and the Republic of Korea in this industry has its own limitations. In particular, in 2022 Russia put the ROK on the list of unfriendly countries. Further political degradation in Russian-South Korean relations, as well as the latter’s alignment with American Indo-Pacific initiatives, could lead to Russia creating obstacles to Mongolia’s supply of rare earth metals to the “Land of Morning Frost.” That possibility is even stronger if they are re-exported from South Korea to other countries that have further damaged their relations with China and Russia: Especially the United States, which has a serious deficit in this important raw material for its high-tech and military-industrial complex. Incidentally, in an interview with Reuters about his visit to Seoul, Oyun-Erdene mentioned the role of South Korea as a “gateway” for Mongolian mining exports to other major economies of the world. It is likely that by such a lengthy formulation he could filibuster just such intentions.

In case of constraining actions on the part of Russia, Mongolia will be forced to switch to cooperation with Russia in this direction. Incidentally, the political groundwork for the Russian-Mongolian partnership had already been laid last year: during his state visit to Russia, Mongolian President Ukhnaagiin Khürelsükh invited Russia to participate in the exploration and development of deposits of rare earth metals. Russia, in turn, has such potential interest – the country has enterprises that need these metals, as well as a good scientific base for exploration and organization of their mining.

Regardless of the final outcome, the Mongolian-South Korean agreement was a notable event in the struggle of the world powers for access to rare earth metals. This bold move by the Mongolian leadership has the potential to improve Mongolia’s economic environment and diversify the geography of its commodity exports. However, it also has the potential to complicate the Mongols’ relationship with their two immediate neighbors. And it is the tectonic shifts at the global level of international relations that will determine the balance between these two most likely consequences.

Boris Kushkhov, the Department for Korea and Mongolia at the Institute of Oriental Studies of the Russian Academy of Sciences, exclusively for the online magazine “New Eastern Outlook.”