Although it cannot be claimed that it is an anti-western coalition based upon some counter proposal or radically different version of the world, its dissatisfaction with and opposition to the current world order and its modus operandi i.e., interventionism is obvious—hence, the BRICS’ slogan of protecting sovereignty of states.

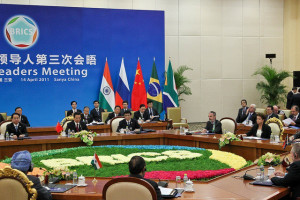

A look at its agenda shows that the BRICS are attempting to present the world with ideas which are not of the Western origin, thereby proposing an alternative yet a competing global narrative. This includes changing the agenda, direction, standing requirements, and collective decision making of the international community in sensitive areas such as multilateral trade negotiations, International Monetary Fund reforms, Security Council and United Nations reforms, completion of climate negotiations etc. At the 2013 summit of BRICS held in South Africa, the Russian President Mr. Putin came up with a proposal to work out a “common concept of international strategy” for the BRICS’ development, and the idea was warmly welcomed by other participants.

The fact that the BRICS countries do not approve of current mechanism of maintaining economic stability at the global level was evident in the last summit where leaders expressed the need for revitalizing the United Nations Conference on Trade and Development’s (UNCTAD) mandate as the focal point in the UN system dedicated to consider the interrelated issues of trade, investment, finance and technology from a development perspective. It is important to note that the BRICS don’t view IMF and World Bank as the basic elements of the United Nations; rather, they prefer to give priorityto UNCTAD instead.

On the other hand, it is also a fact that the BRICS countries are all fast emerging economies and have the potential to impact the international financial conditions to a certain degree. According to a report of The Global Economic Governance Africa (February 2013),in 2012 the average GNP growth for the BRICS was 4 % (in comparison to 0.7% for G7), based on purchasing power parity it was 27% (and constantly growing). In 2010-2013 the average growth was 5.6% for BRICS (1.85% in the developing countries). The total BRICS economy increased 4.2 times during the last ten years (61% in case of developing countries). Similarly, the BRICS economies, if viewed collectively over the last two decades, have emerged as a force to be reckoned with. This is duly reflected by the increasing share of BRICS in the world GDP. From a share of a little over 10% of the world GDP in 1990, the BRICS now command a share of more than 25%. This implies that the economic size of the BRICS in terms of its share in world GDP expanded by 150% in the two decade periods.

As in the case of their share in world GDP, the BRICS’s share in world trade has also improved significantly over the last two decades, from 3.6% to over 15%. The primary contribution to this in terms of value has come from China, whose share has increased from less than 2% to over 9%. This is, however, not to argue that other BRICS countries have not contributed. Their shares have also increased, with Brazil’s share rising from 0.8% to 1.2%; Russia’s from 1.5% to 2.3%; and India’s from 0.5% to 1.8%. South Africa is the only country in the group whose share in world trade has remained constant over the last two decades. A clear example of the BRICS’s rising economic power can be had from the fact that it pledged US$75 billion (of which, $43 billion from China) in June 2012 to the IMF to be used as bailout money for the Eurozone.

Similarly, other figures show that Foreign Direct Investment inflows in the BRICS countries have increased manifold in last decade or so at the growth rate of almost 11%, jumping from $81 billion in 2000 to over $221billion in 2010. In comparison, FDI inflows in some Western industrially advanced countries show a declining trend. The trend of FDI outflows is similar to that of inflows. FDI outflows from the BRICS countries have increased at a growth rate of over 35%, compared with a declining trend in some industrially advanced countries. It shows that the BRICS economies are not only major destinations for FDI, but are also playing an increasingly important role in meeting global demands for capital. And, as far as the share of BRICS economies in global FDI inflows is concerned, in 2010 the group accounted for nearly 18% of total global FDI. What is more important is the fact that since 2000, there has been a sharp increase in the share of these countries in global FDI, when it was recorded at less than 6%.

However, notwithstanding the BRICS’ contribution to the world economy, it is difficult to deny the fact that all of these countries’ economies are heavily dependent upon the US dollar in varying degrees. Although they decided in 2010 to make their currencies inter-convertible, the problem of calculating currencies’ conversion rates remains unresolved. It is because almost entire global economic system is based upon the US dollar. If dollar declines, economies of all of these countries suffer too. If China did not buy American securities, America would suffer. If America suffers, China’s export would decline considerably because of consequent economic decline in the US and EU. And Russia, too, would be unable to get adequate prices for its energy commodities. As a matter of fact, all of these countries accumulate and hold enormous dollar reserves. Ever since the Asian crisis, these countries have felt that this is the only way of protecting themselves against shocks that can destabilize their financial systems.

Although financial power now rests considerably in China`s $3tr reserves, the shift of economic power from Europe and the US to Asia and other emerging economies will not happen overnight. For one thing, the former still enjoy the advantage of advanced technologies. Hydrofracking technology, for example, can make the US almost self-sufficient in gas and oil within a decade. This will also significantly diminish the power and prosperity of the current energy exporting countries, including Russia and those of the Organisation of the Petroleum Exporting Countries. And, despite the current economic crises, the West remains much richer than the rest. The US economy is still three times larger than that of China, with the per capita income of the former ten times that of the latter.

A look at the performance of this coalition in the political arena also shows that the BRICS have taken certain steps which may be interpreted as examples of its departure from traditional policies. The often quoted example of such policies of the BRICS is the vote of abstention it cast in UNO on Libya. However, what is not given due recognition is the fact that both China and Russia have veto power in UNSC where they could have blocked it entirely if they so decided. Moreover, mere abstention of vote could obviously not compel the US and EU to change its policy. On the other hand, Germany also abstained. Should then Germany be considered a part of the BRICS? This is thus obviously not a sufficient explanation of the BRICS’ ‘homogeneity’ and co-ordinated policy.

Similarly, it has been claimed that the BRICS countries are a major hurdle in the way of the EU’s becoming a member of the UNO—an apparently obvious sign of co-ordinated policy. Opposition to the EU’s entry is a principled position of these countries. The UNO is currently composed of states only and inclusion of the EU would tantamount to a revolutionary change in the contemporary international system based upon the principle of state sovereignty. Furthermore, would it also mean that NATO, ASEAN and the BRICS itself should become members of the UNO? It is thus not the power of the BRICS but a systemic compulsion blocking the entry of a regional organization into the UNO, which the BRICS are manipulating to its own advantage.

Furthermore, there are other critical factors which limit the area of operation for the BRICS countries, such as internal differences within the BRICS and clash of interest in certain areas. With a shared and disputed border, China and India distrust each other, and Indian political elites feel intense competition bordering on animosity towards their larger neighbour. South Africa is a country with an exceptionally progressive constitution, whereas Russia does not come to have a ‘comfortable relationship’ with China, although it is a fact that their bi-lateral relations have certainly improved over the last few years. Brazil’s historically close ties with Portugal bring it closer to Europe. Similarly, so far the members have failed to shape a real common foreign policy. There is a problem of unequal representation in the United Nations Security Council as well. The economic interdependence of member states pales in comparison with the degree of their mutual dependence on the very countries the BRICS are attempting to become an alternative to—hence, problems of the so-called ‘leadership role’ of the kind which the US has been playing since the end of Cold War.

However, it cannot be said that the problems are not resolvable. If there are internal difference among the BRICS member, the US and EU, too, are not so homogeneous a coalition as is normally supposed. Even many EU member countries have publicly expressed their dissatisfaction with the Eurozone system, and echoed its replacement or altogether abandonment. Similarly, the EU’s decision of not to participate in the Iraq with the US was also evident of the internal difference existing in the Western world. According to some reports, a main factor behind the US’ systematic reconfiguration of its forces all over the world is uncertainty about the future reliability of long-term allies, especially those in ‘Old Europe.’ To add to it, the financial crises of the West, including that of the US (as was evident in the recent shutdown), are most likely to cripple, to a certain extent, their capacity to manipulate global agendas.

To cap it all, it can be said, in the light of above explained fact and figures, that the BRICS are an economic association gradually moving towards a ‘union.’ Although it has economic and political potential to impact the international system, its effectiveness is limited by its own limitations and by certain systemic constraints. The greatest challenge and the greatest hurdle for them to overcome is to present an alternative financial system along with a currency capable of replacing dollar; for, without it they cannot come into position to make decisions in the international system. It is because of this critical importance of the US dollar that despite two-thirds of the world`s foreign exchange reserves reposing in Asia, decision-making in the global financial institutions still continues to be vested in the West. However, we cannot overlook the fact that if the West fails to resolve its economic and financial crisis, it might have to trade-off the benefit of raising its levels of prosperity against the loss in its global importance, primarily against the rising BRICS coalition, in near future.

Salman Rafi Sheikh, research-analyst of International Relations and Pakistan’s foreign and domestic affairs. Exclusively for the online magazine “New Eastern Outlook”.